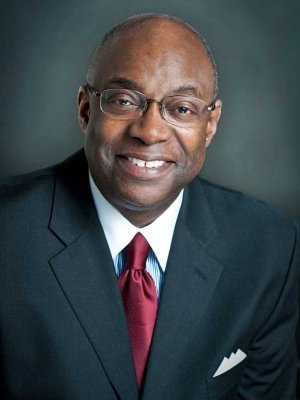

RONALD C. HUNTER, CFP® - Private Wealth Manager

RONALD C. HUNTER, CFP® - Private Wealth Manager

My Value to You

I enjoy working with successful professionals, entrepreneurs, business owners, and retirees to help them make informed decisions about their money so they can save taxes and spend more time focusing on pursuing their important financial goals.

We use a comprehensive process to help our clients address each of their five key concerns: growing and preserving their assets, minimizing taxes, protecting assets against the unnecessary risk of loss, and utilizing smart financial strategies. As a CFP® professional financial planner, I will help you address your important questions:

- Am I invested properly in the right investments; should I be further diversified?

- Am I paying too much in taxes; can I do better; how can I find out?

- Do I have enough to retire; can my savings sustain me in retirement during volatile markets; should I be following CNBC?

- What happens if I need to care for elderly parents; suppose I get sick or worse? How do I make sure my family is cared for?

- Do I need life insurance; should it be term, permanent, or some of both?

For retirees – we work to create lifelong income by avoiding account depletion. Our team of professionals and specialists helps our clients pursue their important goals and save taxes while planning for their estate and legacy concerns.

We start with a 30-minute Zoom meeting. We can follow up if you like for a subsequent Discovery Meeting, where we uncover where you are and where you'd like to be, then identify the gaps and identify the questions required to pursue your goals. We determine if there is a mutual fit for us to work together to create favorable outcomes for your short and long-term objectives. You are invited to request a Zoom Meeting.

CPAs, Business Professionals and Business Owners

For business owners I collaborate with a unique group of professionals using a Team-Based Model, I am able to bring together CPAs, tax attorneys, and business planning specialists who are experienced in sophisticated business strategies such as Cost Remediation, Business Evaluation, Succession Planning and much more. Business owners are able to leverage this experience to seek to reduce taxes, increase cash flow, profitability and overall business value.